ACN addresses the MSMEs financial gap in its monthly topical webinar

ASEAN CSR Network organised a Webinar on Financial Inclusion of Micro, Small and Medium-sized Enterprises (MSMEs) on 21 June 2018.

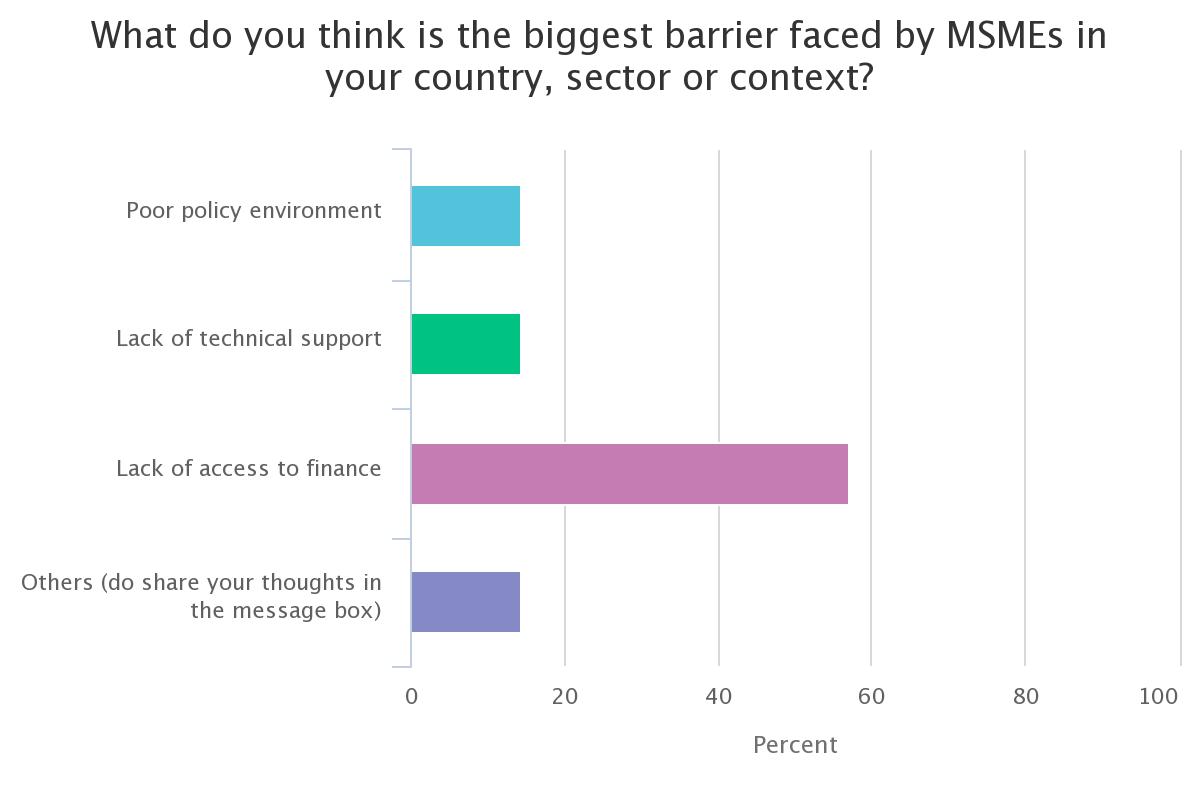

MSMEs form the backbone of the ASEAN economy, making up 89-99% of all enterprises in the region and 52-97% of total employment. A discussion on responsible business and economic development must include this vital group. However, very often MSMEs are excluded from the discussion because they continue to face various barriers particularly in access to external finance. This was showned in the recent study by ASEAN CSR Network, Oxfam, AVPN and ASEAN Business Advisory Council (ASEAN-BAC). The webinar participants also highlighted access to finance as the biggest barrier to MSMEs in their sector/country.

The webinar discussed and identified potential ways to address the financial gap for MSMEs. Proposed ideas include:

- Dynamic financial infrastructure to improve lending efficiency for MSMEs: credit bureaus, collateral registries, movable collaterals, credit guarantees.

- Alternative finance: Angel investing, venture capital, private equity have opened up new possibilities of securing capital for start-ups and SMEs. In this light, regulators’ guidelines that encourage and allow experimentation of innovative financial products and services within the existing regulatory framework can be the crucial first step towards designing enabling regulations for alternative finance to flourish.

- According to Oxfam, most social enterprises take 7-10 years to come close to financial break-even. However, most impact investors adopt 10-year closed-end funds modelled after private equity, which do not match social enterprises’ growth trajectory.

- More patient capital in the form of grants and concessional debt and equity and non-financial support should be provided to enhance the long-term viability of MSMEs.

- Government agencies and Development Finance Institutions (DFIs) could play a catalytic role in using public or development finance to attract private capital. They could consider compensating private investors for what would otherwise be lower than their required risk-adjusted rates of return. There is some evidence that investment into an impact fund by a government-related entity or a DFI increases the attractiveness of the fund.